COVID-19 and Franchising: Seven Months In

It has been more than seven months since the coronavirus pandemic began. Although the business world has been upended, there are signs of improvement...

There’s a good chance you’re familiar with the term franchise, and you may also be generally aware of how franchising works. If you’re exploring the franchise world for the first time, learning the basic terminology is a great place to start.

Franchising is a hybrid business model that combines the power of a known brand with the autonomy of entrepreneurship. The common industry phrase is, "When you buy a franchise, you are in business for yourself, but not by yourself."

The franchise model is used across nearly all industries. There are over 700,000 franchise businesses throughout the country, employing over 8 million people! When executed properly, franchising is a great arrangement for everyone involved.

Here are some of the most common terms you'll hear when exploring franchising.

Discovery Day: Most prospective franchisees learn everything they need to know about a franchise well before discovery day. These primarily face-to-face events are usually held toward the end of the process. They allow franchisors and future franchise owners to meet one another to confirm that they are a good fit.

Franchisor: Think of the franchisor as the parent brand. A franchisor distributes the rights to their system within a designated territory. This includes training, branding, products, intellectual property, marketing, and ongoing support.

Franchisee: A Franchisee is an entrepreneur who owns one or more franchises. The franchisee pays for the rights to operate with the franchisor’s business model.

Franchise Agreement: A franchise agreement is a legal contract between the franchisor and the franchisee that outlines the terms and conditions of the arrangement. This agreement protects both the franchisor and the franchisee and covers the responsibilities of each party.

Franchise Disclosure Document (FDD): A Franchise Disclosure Document (FDD) is the legal document that franchisors are required to provide to franchisees pre-sale. It outlines all items needed to properly run the business, including costs involved and earning potential.

Franchise Fee: A franchisor typically requires new franchisees to pay a one-time fee when they are getting their first franchise unit started. These often range from $20,000 to $50,000.

Lender: A lender in this context is a bank that lends money to entrepreneurs for their businesses. An experienced funding consultant will have a network of partner lenders who understand franchising and are interested in funding franchise buyers.

Rollover for Business Startup (ROBS): Rollover for Business Startup (ROBS) is a funding strategy that allows entrepreneurs to fund their business using their own qualified retirement funds, tax-deferred and debt-free.

SBA Loan: The Small Business Administration (SBA) is a United States government agency responsible for supporting entrepreneurs and small businesses. Despite the name, SBA loans are not distributed by the SBA themselves, but by banks and other financial institutions. The SBA provides a guarantee to those lenders, in order to incentivize them to consider first-time business owners.

Startup Costs: Startup costs are the expenses incurred during the process of starting a new business. With franchises, these costs typically include things like licensing, furniture and fixtures, legal and accounting fees, insurance, among other costs.

With a franchise business, you are buying a proven model. When executed properly, the system benefits all parties at all levels. Franchises represent enormous opportunities across nearly all market segments.

Money is an important part of any business, and franchise businesses are no exception. However, this doesn’t mean that securing capital has to be a pain point. It’s important to work with a funding provider experienced in the franchise space, who can alleviate your fears and guide you through the process so you can focus on getting your business off the ground and becoming profitable.

Whether you’re considering investing in a franchise business for the first time or expanding your existing business, it’s important to understand all of your funding options. Our complimentary webinars with a funding expert are a great place to start. Even if you can’t attend in person, you will receive the on-demand recording with your registration. We look forward to answering any questions you may have!

It has been more than seven months since the coronavirus pandemic began. Although the business world has been upended, there are signs of improvement...

You’re likely familiar with franchising. Franchises are a cornerstone of the American economy, employing millions of people and generating hundreds...

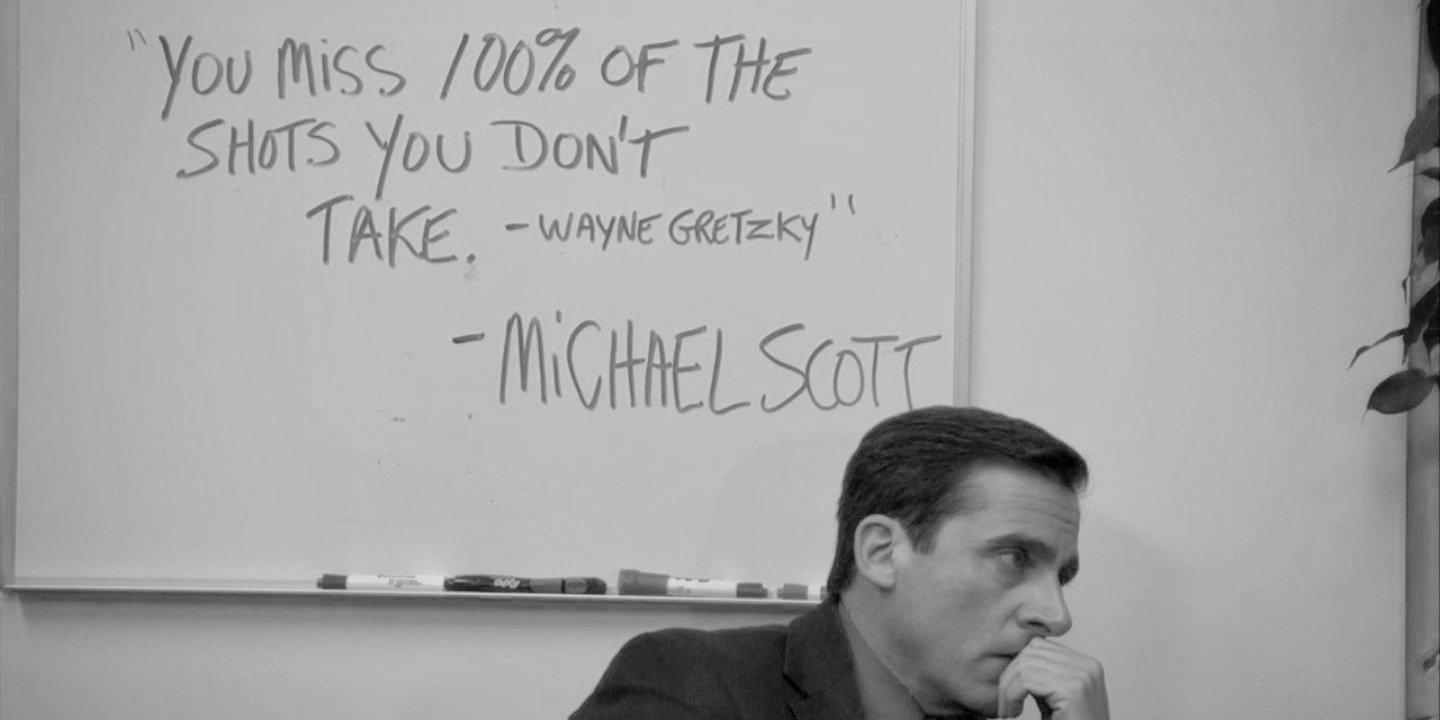

“You miss 100% of the shots you don’t take.”