COVID-19 and Franchising: Seven Months In

It has been more than seven months since the coronavirus pandemic began. Although the business world has been upended, there are signs of improvement...

4 min read

FranFund

:

Jan 22, 2020 10:30:00 AM

FranFund

:

Jan 22, 2020 10:30:00 AM

On December 20, 2019, President Trump signed the SECURE Act into law. SECURE stands for “Setting Every Community Up for Retirement Enhancement.” The purpose of the bill is to extend opportunities for Americans to better save for retirement.

Staying on top of these regulations is important. In this post, we highlight the changes that are most relevant to business owners and explain how they will affect employee retirement plan adoption and management. First, we discuss the Act provisions directly applied to employers that are effective now (plan/tax year after December 31, 2019). Then, we address the changes that will affect employers in the next few years. Finally, we mention other noteworthy amendments that you should be aware of.

Required Minimum Distribution (RMD’s): Effective Dec. 31, 2019

Your required minimum distribution is the minimum amount you must withdraw from your retirement account each year starting at a specific age. The original RMD age was 70.5 years old. This rule was put in place to encourage retirees to spend their funds during their lifetime instead of planning the estate of beneficiaries. However, this regulation was made in the 1960s, and to more accurately reflect current life spans, the Act increased the age to 72, effective Jan 1, 2020. Additionally, the Act allows account owners more time to grow their funds.

Who does this new rule impact?

Annual notice for safe harbor 401(k) plans: Effective Dec. 31, 2019

What is a Safe Harbor plan? It is a type of 401(k) retirement plan that consists of required employer contributions. If an employer chooses to offer a safe harbor plan to employees, they can adopt a matching contribution or a nonelective contribution.

Under the nonelective contribution, the SECURE Act has eliminated the annual non-elective safe harbor notice requirement for this type of contribution. There are no changes regarding the annual notice for matching contributions. As your third party administration, FranFund suggests for you to provide the notice at the beginning of the year that you may be a safe harbor plan. If you experience financial hardship it could get you out of what you have to provide.

Employers can add a nonelective safe harbor option to their plan after the start of a plan year if done before the 30th day before the end of the plan year. Lastly, nonelective safe harbor plans may be adopted up until the close of the following plan year, if the nonelective contribution is at least equal to 4% of employee compensation—not 3%.

Small Employer Start-up and Automatic Enrollment Tax Credit: Effective Dec. 31, 2019

A small employer has less than 100 employees who receive less than $5,000 in compensation. To offset the cost of starting up a retirement plan, the Act increased the tax credit for small employers to adopt a plan. The tax credit is $250 per non-highly compensated employee with a minimum of $500 and a maximum of $5,000 and it applies up to three years. Also, the act created a new tax credit up to $500 per year to incentivize employers to enlist in auto-enrollment. If you want to learn more about this, be sure to speak to your CPA.

Deadline For Adopting Plans: Effective Tax Years Beginning After Dec. 31, 2019

This change permits businesses to treat qualified retirement plans adopted before the due date (including extensions) of the tax return for the taxable year to treat the plan as having been adopted as of the last day of the taxable year.

Read More: Key SECURE Act Provisions and Effective Dates

Increased penalties for failure to file retirement plan returns

The new penalties for account owners filing documents after the deadline have been increased by 10X the old penalties. To avoid the filing penalties, file your retirement plan returns before the last day of the seventh month after the plan year ends (July 31 for a calendar-year plan).

|

Filing/Notice |

Old |

New |

|

Form 5500 |

$25/day |

$250/day (Max $150,000) |

|

Form 8955-SSA |

$1/day |

$10/day (Max $50,000) |

|

Changes to info on 8955-SSA |

$1/day (Max $1,000) |

$10/day (Max $10,000) |

|

Notice of withholding |

$10/day |

$100/day (Max $50,000) |

Long-Time Part-Time Workers: For Plans Effective 2021

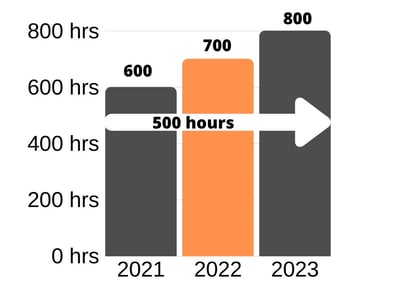

Beginning January 1, 2021, you must allow “long-time part-time” employees to make elective deferral contributions To be considered a “long-time part-time” worker, an employee must be at least 21 years old, work 3 consecutive 12-month periods, and have at minimum 500 recorded hours per year. Society for Human Resource management states employers may continue to exclude these part-time employees from safe harbor employee contributions and compliance testing.

For Example:

If an employee were to work for you from 2021-2023 with the following hours shown in the graph, you would be required to allow them to make contributions during the plan year beginning in 2024.

Credit card loan payments: Effective Dec. 31, 2019

Most retirement plans offer employees the opportunity to take out a loan and repay with interest. The benefit is that interest is paid back to your plan versus a financial institution. Investopedia explains the opportunity cost is that the repayment to the account is no longer tax-free. To discourage people from using retirement loans for routine or small purchases, the Act is prohibiting the distribution of plan loan repayments through credit cards and other similar arrangements.

Compensation:

Payments made for “difficulty of care” are exempt from income taxes. These individuals are still getting paid, so the difficulty of care payments are in addition to their income. This income was previously allowed to be claimed but because many home health care workers do not have taxable income this is problematic. Without taxable income, these individuals cannot save for retirement. So, the Act is changing the IRS’s definition of compensation to include “difficulty of care” payments. When you are reporting compensation on your Census be sure to include an additional column with the difficulty of care payments.

As our expert team of third-party administrators oversees your FranPlan, we want to ensure that you are informed of how these changes could impact you. If you have any questions, please feel free to contact your plan associate. If you would like to learn more about the SECURE Act of 2019 be sure to read more about it.

It has been more than seven months since the coronavirus pandemic began. Although the business world has been upended, there are signs of improvement...

After turning another page of the calendar in 2020, we will celebrate another major holiday in the middle of a pandemic. While our 4th of July...

For ambitious entrepreneurs debating their best funding options for their business, this question is often posed: Can I use my 401(k) as an...